Apple is engaged on a brand new service that enables small companies to simply accept plastic card funds instantly from the iPhone with out utilizing extra terminals. That is reported by Bloomberg, citing folks conversant in the matter.

In response to studies, the corporate has been engaged on a brand new characteristic since 2020; then it acquired the Canadian startup Mobeewave for $100 million; which developed a know-how that enables smartphones with NFC modules to simply accept cost by financial institution playing cards. NFC is already in use on the iPhone for Apple Pay funds.

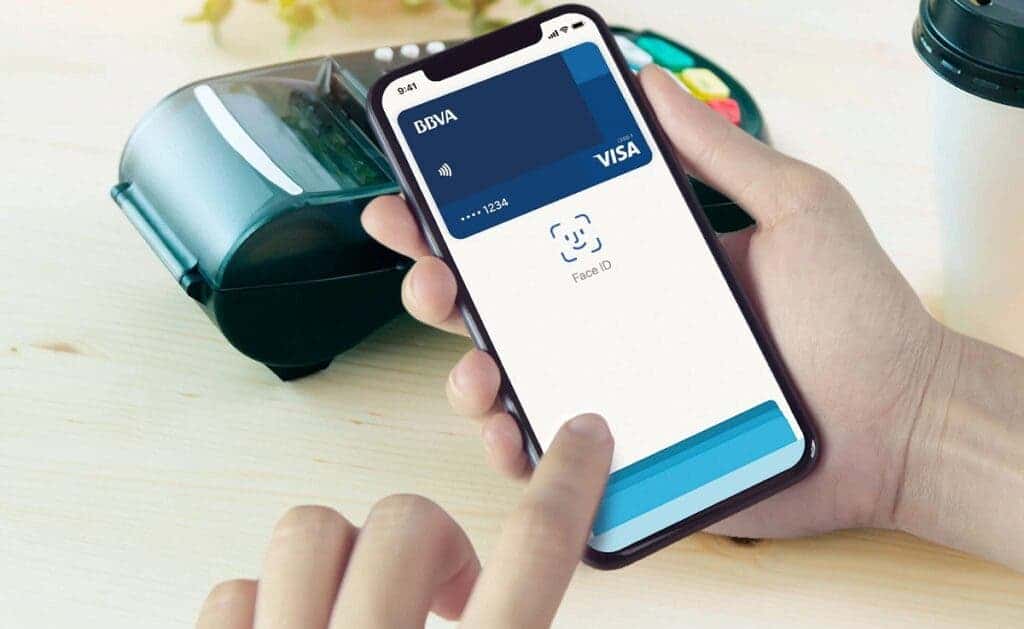

To just accept funds on the iPhone, retailers in some international locations can already use particular terminals linked to the smartphone through Bluetooth – a market dominated by Sq. know-how developed by Block Inc. The brand new characteristic will flip the iPhone itself right into a cost terminal, permitting small companies like meals service homeowners and hairdressers to simply accept funds from financial institution playing cards or appropriate smartphones.

We have no idea whether or not the likelihood might be a part of the Apple Pay ecosystem and the way Apple will implement this selection. Apple will begin rolling out software program updates within the coming months. The corporate anticipated to current the primary beta model of iOS 15.four within the close to future; and the discharge for the mass consumer will happen, presumably within the spring. Apple itself declined to remark.

Apple will can help you use the iPhone as a cost terminal

The corporate has lengthy been attempting to enter the funds market: in 2019 within the US; it launched the Apple Card, launched Apple Money digital service for digital transactions; and is contemplating an Apple Pay service that lets you pay for purchases in installments.

The iPhone gained’t be the primary smartphone to make use of Mobeewave know-how to simply accept funds. Samsung, which backed the startup till it was bought to Apple, was utilizing financial institution card funds on a few of its units as early as 2019.

It’s price mentioning that Samsung has found out the best way to shield and make sure the safety of financial institution playing cards. It recommended embedding a fingerprint scanner within the “plastic”. The corporate itself positions the answer because the trade’s first complete resolution that lets you learn biometric data by way of a fingerprint sensor, retailer and acknowledge encrypted knowledge, and analyze and course of knowledge by way of a safe chipset.

So, Samsung built-in the chip, fingerprint sensor and safety module into one chip. Cost playing cards with such a microchip will make the method of creating purchases secure and quick. As well as, biometric authentication eliminates the necessity to enter a PIN code on a keypad; and likewise minimizes the possibility of fraudulent transactions with misplaced or stolen playing cards.